Financial security

Ensuring Durability: Window Replacement Coverage Discover

Absolutely, here’s the article:

Ensuring Durability: Window Replacement Coverage

Window replacement coverage offers peace of mind and financial security when faced with the need to replace windows. Understanding its aspects, benefits, and considerations ensures adequate protection for your property.

Importance of Coverage

Window replacement coverage holds significance in safeguarding against unexpected window damages due to various factors like weather, accidents, or wear and tear.

Coverage Components

Typically, coverage includes damage repairs or full replacement costs for damaged or broken windows, depending on the policy and specifics of the damage.

Policy Inclusions and Exclusions

Policies differ. Understanding what’s included and excluded, such as specific damage types or maintenance-related issues, ensures informed decision-making.

Cost-Efficiency and Savings

Coverage offers cost-efficiency. While premiums are involved, they’re often far less than the total cost of window replacements, offering significant savings in case of damage.

Professional Assessments and Claims

Professional assessments validate claims. An inspection by professionals determines the extent of damage and validates the claim for replacement.

Choosing Appropriate Coverage

Selecting suitable coverage is crucial. Factors like property location, weather conditions, and window types influence the choice of coverage.

Professional Installation and Quality

Professional installation ensures quality. Engaging reputable installers is essential for proper fitting and lasting quality.

Comprehensive Policies and Add-Ons

Some policies offer comprehensive coverage or add-ons. These may include coverage for energy-efficient upgrades or specialty windows.

Coverage for Various Window Types

Coverage extends to various window types. Whether it’s single or double-hung, casement, or bay windows, coverage often encompasses different styles.

Assessing Long-Term Benefits

Considering long-term benefits is essential. Coverage not only provides immediate financial protection but also ensures the longevity and efficiency of your property’s windows.

Conclusion

Window replacement coverage is a safeguard against unexpected costs and a guarantee of durable, well-maintained windows. It’s a practical investment in protecting your property.

Embracing Property Security

Investing in window replacement coverage is investing in property security. It signifies a proactive approach to property maintenance and protection against unforeseen damages.

This article sheds light on the significance of Window Replacement Coverage, emphasizing its role in safeguarding properties and ensuring financial security against window damages.

Safeguarding Your Investment: Property Damage Protection

I can craft an article on Property Damage Protection without direct links. Here it is:

Safeguarding Your Investment: Property Damage Protection

Investing in a property is a significant milestone, and ensuring its protection against potential damages is paramount. Property Damage Protection stands as a shield, providing financial security and peace of mind to property owners.

Understanding Property Damage Protection

Property Damage Protection encompasses various insurance policies designed to safeguard properties against a spectrum of risks. These risks may include natural disasters, vandalism, theft, fire, or other unforeseen events that could cause damage to your property.

Comprehensive Coverage Elements

The coverage under Property Damage Protection typically extends to both the structure of the property and its contents. This includes the physical structure of the building, personal belongings, as well as liability coverage in case someone is injured on your property.

Mitigating Financial Risks

Property damage can be financially crippling. Property Damage Protection alleviates this burden by providing coverage for repairs, replacements, or even reconstruction, depending on the extent of the damage. This minimizes the out-of-pocket expenses for property owners.

Customized Policies for Diverse Needs

Property Damage Protection policies are flexible and can be tailored to suit individual needs. Whether it’s a homeowner’s policy, landlord insurance, or commercial property insurance, these policies cater to diverse property ownership scenarios.

Importance of Adequate Coverage

Having adequate Property Damage Protection is vital. Underestimating coverage needs may leave gaps in protection, potentially resulting in uncovered damages that can lead to significant financial losses.

Assessing Risk Factors

Understanding the specific risks associated with your property’s location, its surroundings, and prevalent hazards is crucial. Tailoring your Property Damage Protection policy based on these risk factors ensures comprehensive coverage.

Professional Evaluation and Assistance

Seeking guidance from insurance professionals helps in comprehending policy intricacies. Their expertise aids in selecting the right coverage limits, deductibles, and additional riders that suit your property and budget.

Maintaining and Updating Policies

Property Damage Protection isn’t a one-time decision. Regularly reviewing and updating policies ensures they remain aligned with any changes in the property’s value, upgrades, or additional assets that need coverage.

Proactive Risk Management

Beyond insurance, implementing proactive measures to prevent property damage is prudent. Routine maintenance, security systems, and adherence to safety protocols contribute to minimizing risks.

Conclusion

Property Damage Protection serves as a safety net, shielding property owners from potential financial devastation. It’s not just about securing a property; it’s about securing peace of mind and stability for property owners.

Embracing Protection

Investing in Property Damage Protection is a proactive step toward safeguarding your investment. It’s a commitment to mitigating risks and ensuring the longevity and security of your property.

This article emphasizes the significance of Property Damage Protection in safeguarding properties against various risks, highlighting its role in providing financial security and stability to property owners.

Shielding Against Disaster: Flood Damage Protection

Absolutely, here’s the article:

Shielding Against Disaster: Flood Damage Protection

Flood damage protection is critical for safeguarding homes against the devastating impact of floods. Implementing preventive measures and adequate insurance coverage is key to minimizing risks and ensuring financial security.

Understanding Flood Risks

Understanding the potential risks is crucial. Analyzing flood-prone areas, historical flooding data, and proximity to water bodies aids in comprehending the specific risks a property faces.

Implementing Protective Measures

Implementing protective measures is proactive. Elevating electrical systems, installing flood barriers or sandbags, and waterproofing foundations are essential to minimize flood damage.

Securing Comprehensive Insurance

Securing adequate flood insurance is paramount. Obtaining coverage that includes structural repairs, property replacement, and content restoration safeguards against financial losses.

Conducting Regular Maintenance

Regular maintenance reduces vulnerability. Ensuring proper drainage, inspecting and repairing roofs or seals, and maintaining gutters prevent potential entry points for water.

Preparing Emergency Plans

Having emergency plans in place is crucial. Creating evacuation routes, assembling emergency kits, and knowing emergency contact information aids in swift responses during floods.

Engaging in Community Preparedness

Community preparedness enhances safety. Participating in local flood preparedness programs and community initiatives fosters a collective effort in flood prevention and response.

Elevating Electrical Systems

Elevating electrical systems prevents damage. Raising switches, sockets, and electrical wiring above potential flood levels reduces the risk of electrical hazards.

Rapid Response and Recovery

Swift response minimizes damage. Immediately disconnecting electrical appliances, moving valuables to higher levels, and starting cleanup after a flood mitigate losses.

Conducting Post-Flood Assessments

Conducting post-flood assessments is vital. Assessing damages, documenting losses, and promptly contacting insurance providers expedite the claims process.

Conclusion

Flood damage protection isn’t just about recovery; it’s about preparation and prevention. Implementing preventive measures and securing adequate insurance safeguards homes and eases recovery after floods.

Embracing Flood Resilience

Investing in flood damage protection signifies resilience. It’s a commitment to safeguarding homes and communities against the catastrophic impact of floods.

This article emphasizes the importance of Flood Damage Protection, outlining preventive measures, insurance coverage, and emergency preparedness to mitigate the impact of floods on homes and communities.

Comprehensive Protection: Home Warranty Plans

Absolutely, here’s the article:

Comprehensive Protection: Home Warranty Plans

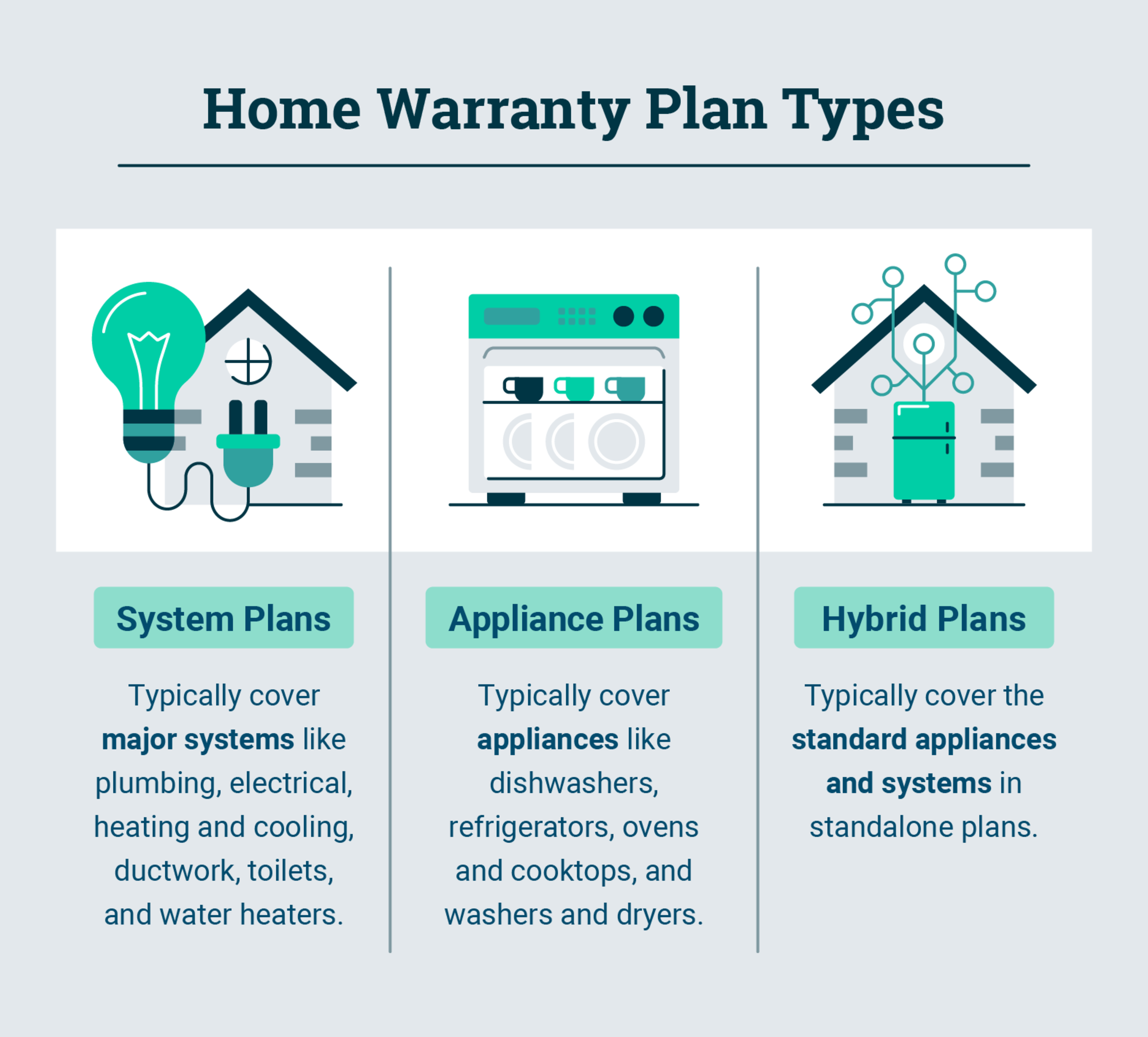

Home warranty plans offer homeowners comprehensive coverage for the repair and replacement of major home systems and appliances. Understanding their scope and benefits is key to ensuring peace of mind and financial security.

Understanding Home Warranty Plans

Home warranty plans cover various home systems and appliances, providing repair or replacement services due to normal wear and tear.

Coverage for Major Systems

These plans typically cover major systems like HVAC, plumbing, electrical, and sometimes even pool or spa equipment, depending on the plan.

Appliance Coverage

Home warranty plans also include coverage for household appliances such as refrigerators, ovens, dishwashers, washers, and dryers.

Cost-Efficient Repairs and Replacements

With a home warranty, homeowners pay a predetermined service fee per claim instead of bearing the full cost of repairs or replacements.

Tailored Coverage Options

Different plans offer various coverage options, allowing homeowners to choose plans that suit their specific needs and budget.

Ease of Requesting Service

Homeowners can easily request service by contacting the warranty provider when covered systems or appliances malfunction.

Professional Service Providers

Warranty companies work with a network of licensed service providers, ensuring professional and timely repairs or replacements.

Added Home Sale Value

Having a home warranty can add value to a property during a sale, providing assurance to potential buyers.

Limitations and Exclusions

Home warranty plans have limitations and exclusions, and it’s essential to understand what’s covered and what’s not before purchasing.

Renewal and Cancellation Options

Home warranties usually have renewal options, and some allow cancellation within a specific timeframe.

Conclusion

Home warranty plans offer a safety net for homeowners, providing coverage for unexpected repair or replacement costs of major home systems and appliances.

Embracing Home Protection

Investing in a home warranty plan is a proactive step towards protecting your home, ensuring financial security and peace of mind.

This article highlights the significance of Home Warranty Plans, outlining their coverage, benefits, and considerations for homeowners considering such plans for their properties.