Highlight News

The Impact of Leverage: Understanding Margin Calls in Trading

Trading in financial markets offers immense opportunities for profit, but it comes with its own set of risks. One of the key mechanisms that traders employ to amplify their potential returns is leverage. However, while leverage can magnify gains, it can also lead to significant losses, particularly through the mechanism known as a margin call. This article delves into the intricacies of leverage, the concept of margin calls, and the strategies traders can employ to manage their risks effectively.

Understanding Leverage in Trading

Leverage, in the context of trading, refers to the use of borrowed capital to increase the potential return on an investment. Essentially, it allows traders to control larger positions than they could with their capital alone. The concept of leverage is not limited to financial markets. It also extends to business operations, where operating leverage is used to indicate the proportion of fixed costs in a company’s cost structure. A high level of operating leverage means that a company can significantly increase its profitability with a relatively small increase in sales. However, this also means that during downturns, losses can accumulate rapidly.

The benefits of leverage are compelling. By allowing traders to engage in larger trades, leverage enables them to amplify potential returns. Furthermore, with less capital tied up in individual trades, traders can diversify their portfolios, spreading their investments across multiple assets. This diversification can reduce risk, provided that the assets are not closely correlated. However, it is essential to understand the margin call definition, as it is crucial to grasp how leverage impacts a trader’s account and the risks involved.

The Risks Associated with Leverage

While leverage can enhance potential returns, it is important to understand the risks involved. One of the most significant dangers is the increased potential for losses. When a trader uses leverage, they are not only increasing their exposure to potential gains but also to potential losses. If the market moves against their position, losses can exceed the initial investment. This possibility is particularly concerning for inexperienced traders who may not fully grasp the implications of trading on margin.

Beyond financial losses, trading with leverage can have profound emotional and psychological effects on traders. The high stakes associated with leveraged positions can lead to heightened stress and anxiety. As losses mount, traders may find themselves making impulsive decisions, deviating from their planned strategies. The pressure to recover losses can lead to a vicious cycle of poor decision-making, often resulting in even larger losses.

Understanding Margin and Margin Calls

Margin is the amount of money that a trader must deposit to open a leveraged position. It serves as a form of collateral for the borrowed funds. There are two main types of margin: initial margin and maintenance margin. The initial margin is the minimum amount that a trader must deposit to enter a position, while the maintenance margin is the minimum equity that must be maintained in the account to keep the position open.

Margin calls occur when a trader’s account …

Why North Kansas City Businesses Choose Windward FP for Financial Planning

In the competitive landscape of North Kansas City, businesses face numerous financial challenges that require astute management and strategic foresight. As companies strive to thrive in this dynamic environment, many are turning to specialized financial services to ensure their long-term success. Among the various options available, Windward FP stands out as a preferred choice for financial planning. This article delves into the reasons why businesses in North Kansas City are choosing Windward FP, highlighting its unique offerings and the advantages it provides to its clients.

Comprehensive Wealth Management Services

One of the primary reasons businesses in North Kansas City opt for Windward FP is its comprehensive range of wealth management services. Financial planning is not a one-size-fits-all solution, and Windward FP recognizes that each business has unique needs and goals. The firm’s approach combines investment management, retirement planning, tax strategies, and estate planning, all tailored to fit the specific circumstances of its clients. This holistic strategy ensures that every aspect of a client’s financial health is addressed, allowing businesses to focus on growth and operational efficiency without the distraction of managing their finances.

Moreover, Windward FP employs a team of experienced wealth managers Kansas City trusts, who bring a wealth of knowledge and expertise to the table. This team is dedicated to understanding the intricacies of each client’s financial situation, enabling them to create customized plans that align with both immediate and long-term objectives. With this level of personalized attention, businesses can rest assured that they are making informed financial decisions that contribute to their overall success.

Local Expertise and Community Focus

Another significant factor that draws North Kansas City businesses to Windward FP is its local expertise and commitment to the community. Being situated in the heart of North Kansas City allows the firm to stay attuned to the unique economic landscape and trends that affect local businesses. This proximity fosters a deeper understanding of the challenges and opportunities specific to the region, which is invaluable when crafting effective financial strategies.

Windward FP’s involvement in the local community extends beyond mere geographic presence. The firm actively participates in community events and initiatives, reinforcing its commitment to supporting the growth of local businesses. By aligning its goals with the prosperity of the North Kansas City area, Windward FP builds lasting relationships with its clients, creating a network of trust and collaboration that benefits everyone involved. This community-centric approach not only enhances the firm’s credibility but also positions it as a vital partner in the success of local businesses.

Innovative Technology and Personalized Support

In today’s fast-paced business environment, having access to the latest technology can significantly enhance financial planning efforts. Windward FP leverages innovative financial tools and software to provide clients with real-time insights into their financial health. This technology allows businesses to track their financial performance, analyze investment options, and make data-driven decisions efficiently. The integration of advanced technology into the financial planning process enables Windward FP to deliver a level of service that sets it apart from traditional …

Hydrolyzed Collagen Peptides: Unlocking the Benefits of Enhanced Collagen Absorption

Hydrolyzed collagen peptides have gained significant attention in the wellness and beauty sectors for their remarkable ability to promote skin health, support joints, and improve overall well-being. Collagen, a naturally occurring protein in the body, plays a vital role in maintaining the structure of skin, bones, muscles, and connective tissues. However, as we age, our collagen production slows down, leading to wrinkles, joint pain, and other signs of aging. Hydrolyzed collagen peptides offer an efficient solution, thanks to their enhanced bioavailability. In this article, we’ll explore what hydrolyzed collagen peptides are, how they work, and their numerous health benefits.

What Are Hydrolyzed Collagen Peptides?

Hydrolyzed collagen peptides are collagen proteins that have been broken down into smaller, more easily digestible amino acid chains through a process called hydrolysis. This makes them more readily absorbed by the body compared to regular collagen. The smaller peptide molecules can be quickly taken up by the bloodstream and utilized in repairing tissues, improving skin elasticity, and supporting joint function.

Unlike whole collagen, which can be difficult to digest and absorb hydrolyzed collagen peptides ensure that your body can efficiently use the collagen you consume.

How Do Hydrolyzed Collagen Peptides Work?

When you ingest hydrolyzed collagen peptides, they enter your digestive system and are absorbed into the bloodstream. Once in the bloodstream, they travel to various tissues, including the skin, joints, and bones, where they stimulate the production of new collagen. Additionally, these peptides trigger the body’s fibroblasts (cells responsible for producing collagen) to ramp up collagen production, which helps restore and maintain the structure of these tissues.

Health Benefits of Hydrolyzed Collagen Peptides

- Improves Skin Elasticity and Reduces Wrinkles

One of the most sought-after benefits of hydrolyzed collagen peptides is their ability to enhance skin health. Regular consumption of these peptides has been shown to reduce the appearance of fine lines and wrinkles, improve skin elasticity, and increase moisture levels. By stimulating collagen production, hydrolyzed peptides help maintain the skin’s firmness and hydration, giving it a more youthful appearance. - Supports Joint Health and Mobility

Collagen is a key component of cartilage, which cushions the joints and allows for smooth, pain-free movement. As we age, our natural collagen levels decline, leading to joint stiffness and discomfort. Hydrolyzed collagen peptides have been shown to reduce joint pain and improve mobility, especially in individuals with osteoarthritis or other degenerative joint conditions. By providing the building blocks needed for cartilage repair, hydrolysed collagen peptides help promote joint flexibility and reduce inflammation. - Enhances Muscle Mass and Recovery

Collagen peptides play a role in muscle repair and recovery, making them a valuable supplement for athletes and individuals engaged in regular physical activity. The amino acids found in hydrolyzed collagen, particularly glycine and proline, help in the repair of muscle tissues after exercise, reducing muscle soreness and speeding up recovery. Additionally, collagen peptides have been found to support muscle mass retention, which is particularly important for older adults experiencing age-related muscle loss (sarcopenia). - Strengthens Hair and Nails

Hydrolyzed collagen peptides can

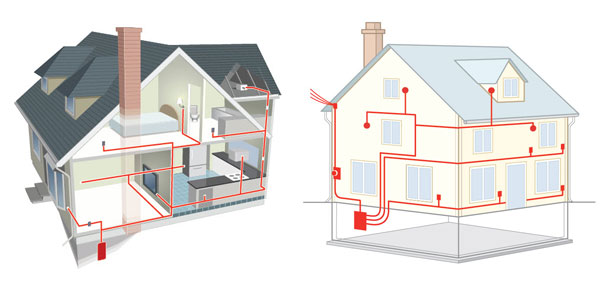

Revolutionizing Home Electrical Systems: The Future of Smart Technology

Key Takeaways

- Discover how smart technology is transforming home electrical systems.

- Learn about the latest smart devices that can optimize energy consumption and enhance home security.

- Understand the benefits of integrating smart electrical systems in modern homes.

- Get insights into future trends and innovations in smart home technology.

Introduction to Smart Electrical Systems

Smart technology has rapidly integrated into various aspects of our lives, revolutionizing how we interact with our home environments. Smart electrical systems are at the forefront of this transformation. They enhance convenience, improve energy efficiency, and bolster home security. With the rise of devices like smart thermostats and intelligent lighting systems, the days of traditional electrical systems are numbered. Efficient electrical project management Philadelphia PA, is integral to successfully adopting these advanced systems and ensuring they operate optimally.

Homeowners today seek solutions that make their lives more comfortable, reduce operational costs, and improve safety. A well-managed electrical project can seamlessly integrate smart technology into existing infrastructures, promoting a harmonious blend of form and function. The seamless integration of these technologies requires meticulous planning and execution to achieve the perfect synergy of functionality and aesthetic appeal, ensuring that modern homes are equipped with the best technology without compromising on design.

Optimizing Energy Efficiency

The capacity of smart electrical systems to optimize energy use is one of their greatest benefits. Devices like smart thermostats can learn your habits and adjust the temperature automatically, which reduces energy waste and saves money. Smart lighting systems can also be configured to turn off when not in use, which reduces energy usage even further.

Smart Thermostats

Smart thermostats, such as Nest and Ecobee, are designed to learn your schedule and preferences. By automatically adjusting settings, they help maintain an energy-efficient environment. These devices can be controlled remotely, providing additional flexibility and savings by ensuring that energy is not wasted on an empty home. According to studies, smart thermostats can reduce a homeowner’s annual heating and cooling costs by up to 10%–15%, making them an excellent purchase for consumers who care about the environment.

Smart Lighting

Lighting systems, like Philips Hue and LIFX, offer unprecedented control over home lighting. To ensure that energy is not spent on unoccupied places, they can be programmed to turn on and off at specific periods or even changed based on occupancy. These systems can also be integrated into broader smart home systems, enhancing both convenience and energy efficiency. Additionally, having the option to switch up the lighting settings and colors can significantly improve the atmosphere in your living areas, increasing the effectiveness and enjoyment of your house.

Enhancing Home Security

Home security has seen tremendous improvements with the advent of smart technology. Smart electrical systems include features like automated lighting that can deter potential intruders by simulating occupancy. Moreover, smart locks and surveillance systems provide homeowners with real-time alerts and remote access to their security systems, making homes safer than ever.

Automated Lighting

Automated lighting systems can be programmed to simulate occupancy while you are away, deterring …

Keeping Your Home Elevator Running Smoothly

Finding Reliable Repair Services Near You

The Importance of Professional Expertise

Local Expertise: The Benefits of Choosing a Nearby Service

Finding the Right Service: Research and Recommendations

Common Elevator Problems and Solutions

Ensuring Safety and Reliability

…

Enhancing Your Dining Room with Wall Decor

Setting the Stage

The Art of the Gallery Wall

The Power of Statement Pieces

Mirrors: Expanding Space and Reflecting Light

Wall Plates: A Touch of Nostalgia and Charm

Textured Wallpaper: Adding Depth and Dimension

Wall Shelves: Displaying Treasures and Collections

Lighting: Enhancing the Ambiance

Creating a Cohesive Look

…

Creating a Memorable First Impression

Fashion Shop Design Ideas

The exterior of a fashion shop is the first thing customers see. A well-designed storefront can create a lasting impression and entice potential customers to enter. Consider using eye-catching signage, unique architectural elements, and appropriate lighting to make your shop stand out.

Interior Design: Setting the Mood

The interior design of a fashion shop should reflect the brand’s personality and target audience. Consider the following elements:

- Color palette: Choose colors that evoke the desired emotions and align with the brand’s aesthetic.

- Lighting: Use lighting to create a specific atmosphere, whether it’s warm and inviting or cool and modern.

- Layout: Arrange the shop layout to facilitate customer flow and highlight key products.

- Fixtures and displays: Use visually appealing fixtures and displays to showcase merchandise effectively.

Merchandising Techniques

Effective merchandising can significantly impact sales. Consider these techniques:

- Visual storytelling: Create themed displays that tell a story and engage customers.

- Product placement: Place popular or high-margin items in strategic locations to maximize visibility.

- Cross-selling: Suggest complementary products to increase the average order value.

Customer Experience

A positive customer experience is essential for building loyalty. Consider the following factors:

- Staff training: Ensure your staff is knowledgeable and friendly to provide excellent customer service.

- Fitting rooms: Provide comfortable and well-lit fitting rooms for customers to try on merchandise.

- Amenities: Offer amenities like Wi-Fi, refreshments, or a lounge area to enhance the shopping experience.

Technology Integration

Technology can enhance the shopping experience and improve efficiency. Consider incorporating the following:

- Digital signage: Use digital signage to display product information, promotions, and visual content.

- Mobile apps: Develop a mobile app to offer exclusive deals, loyalty programs, and personalized recommendations.

- Self-checkout: Implement self-checkout stations for a faster and more convenient checkout process.

Sustainability and Eco-Friendliness

In today’s environmentally conscious world, sustainability is increasingly important. Consider incorporating eco-friendly elements into your shop design, such as:

- Sustainable materials: Use sustainable materials for fixtures, displays, and decor.

- Energy-efficient lighting: Install energy-efficient lighting to reduce your carbon footprint.

- Recycling and waste reduction: Implement recycling programs and reduce waste generation.

Accessibility

Ensure your shop is accessible to all customers, including those with disabilities. Consider features such as:

- Ramps and elevators

- Accessible restrooms

- Assistive technology

By carefully considering these factors, you can create a fashion shop that not only attracts customers but also provides a memorable and enjoyable shopping experience.…

Fashion Shopping Bag Design A Deeper Dive

The Functional Aspect

A fashion shopping bag, beyond its aesthetic appeal, serves a crucial functional purpose. It’s designed to safely transport purchases, protecting them from damage and ensuring they reach their destination intact. Durability is paramount, especially for bags intended to carry heavy or fragile items. The choice of materials, such as sturdy canvas, reinforced handles, and secure closures, plays a significant role in ensuring longevity.

The Aesthetic Appeal

The aesthetic appeal of a fashion shopping bag is equally important. It’s often the first impression a customer has of a brand, and it can significantly influence their perception of quality and style. A well-designed bag can become a coveted accessory, reinforcing the brand’s identity and creating a sense of exclusivity. Elements like color, pattern, and texture can be used to convey a brand’s personality and target audience.

The Branding Opportunity

A fashion shopping bag offers a unique opportunity for branding. It’s a portable billboard that can reach a wide audience. Incorporating the brand’s logo, tagline, or signature motifs can help increase brand awareness and recognition. Consistent branding across different elements of the bag, such as the handles, closures, and interior lining, can create a cohesive and memorable impression.

The Eco-Friendly Trend

In recent years, there has been a growing emphasis on sustainability and eco-friendliness in the fashion industry. This trend has extended to shopping bag design. Consumers are increasingly seeking bags made from recycled materials, biodegradable fabrics, or sustainable sources. By choosing eco-friendly options, brands can demonstrate their commitment to environmental responsibility and appeal to a conscious consumer base.

The Customization Option

Customization offers a way to create unique and personalized shopping bags. Brands can allow customers to choose from a variety of materials, colors, and designs, or offer the option to add custom messages or artwork. This level of personalization can enhance the customer experience and foster a sense of connection with the brand.

The Impact on Customer Experience

The design of a shopping bag can have a significant impact on the overall customer experience. A well-designed bag can create a positive impression, leaving customers feeling valued and satisfied with their purchase. Conversely, a poorly designed bag can detract from the shopping experience and damage the brand’s reputation. By investing in thoughtful and innovative shopping bag design, brands can elevate their customer experience and build lasting loyalty.…

How Commercial Lending Software Can Increase Your Revenue

Commercial Lending Software: In the highly competitive financial world today, technology is no longer optional but highly essential. Commercial lending combines banks, credit unions, and specialized lenders. Consequently, it comes under a double bind, with increasing pressure to make more money, but not at the expense of efficient risk management. The key to revenue growth lies in smooth commercial lending software. This blog covers ways in which commercial lending software can powerfully improve your bottom line.

What is Commercial Lending Software?

Commercial lending software is a particular computer program that authorizes commercial lending on the buyer side. It allows the lender to smartly evaluate loan requests, spot the risks related to every loan, and monitor active braces. For all the above-mentioned reasons, the commercial loan software will surely be beneficial in all ways: lender and borrower.

Ways Commercial Lending Software Helps Increase Revenue

1. Streamline Your Lending Processes

The whole process is labor-intensive and time-consuming, which is one of the greatest challenges in commercial lending. From the collection of required documentation to underwriting, traditional methods can considerably slow down the approval process. Commercial lending software automates most of these tasks, reducing application processing time.

Automation of regular tasks, such as data entry, document collection, and compliance checks, can speed up the application processing for lenders and help them process more applications in less time. This increased productivity also enables you to handle more clients, which means more revenue on your bottom line. Moreover, automation minimizes the chances of human error and ensures that your operations go without hitches and on target.

2. Data Analytics to Improve Decision-Making

The major benefit of commercial lending software is the unlocking of data analytics. Most modern commercial lending platform use advanced algorithms to analyze credit data, financial statements, and market trends, which can be very useful to lenders in making fully informed decisions.

With the right information at your fingertips, you can better understand risk and, hence, provide your customers with just the right kind of loan products. This helps capture more customers who look for a personalized approach to finance. More loans that you can confidently approve in safety translate into greater revenues.

3. Improve Customer Experience

Customer experience is clients’ main attractant and retainer in today’s digital era. Commercial lending platforms help you streamline the process and give your customers a hassle-free and friendly user experience. Online applications, instant approvals, and real-time updates throughout the process make it quite convenient for clients, too, and result in enhanced customer satisfaction and loyalty.

Besides, integration of the Document Management System (DMS system) into your lending platform can create more value for customers. A DMS system allows for secure warehousing and easy retrieval of important documents to smooth the documentation presentation process by borrowers and its review by lenders or the finance company. This improved customer experience leads to increased repeated business and referrals, therefore influencing your revenue growth positively.

4. Decrease Operational Costs

While increasing revenue is one of the main concerns, cost control …

Expert Tips to Choose the Best Security Services in Dubai

Dubai is a very active city and this makes guard of homes, businesses, and properties a very important factor. Because of the migration of numerous people to urban areas and because of the increase in the global population density of world cities, there is a need to employ professionally best security services. Anyone owning an enterprise, a house, or being in charge of a big commercial property well knows that the role of security service selection is critical for the protection of the owner’s property and for people’s peace of mind.

Understand security needs

But what should be defined before getting to the selection process of products and solutions is what exact security you need in particular. It should, however, be understood that the specifications of such conditions may differ greatly.

The following are some of the steps that can be taken while designing your business plan: The first step, therefore, is to assess the attributes of your property and other things to identify risks. To the business person, then one should be thinking of the type of business, the value of the property within the business premise and the amount of contact with the customers. As far as homes are concerned, read the size of the house, where it is situated and any alterations done to warrant some work.

Licensing of institutions and programs and accreditation of institutions and programs

It is worth revealing that security services in Dubai state have legal requirements and measures that cover the rights of both clients and guards. Hence the need to go for a security provider that is licensed and accredited to provide security services. Security companies that are certified are supposed to follow certain laid-down codes of practice, hence providing competent and qualified personnel.

Request licensing and accreditation each time you want to hire a security service. This not only makes sure that the provider you are dealing with is real, but also ensures that guards will be able to deal with a range of events.

Experience and reputation matter.

This is one of the factors that should be considered when hiring security services: the experience they possess. Experience is expected to improve the quality of services delivered to clients by a company established for a long time. Professionals in security provision are in a better position to understand the prevailing security situation within the area, the risks, and how to handle them depending on the prevailing security threats.

First of all, look for several potential candidates among the security companies. Appeal to documents it has written that include reviews, testimonials, and case studies that can show its competence and effectiveness in a similar scenario.

Customized Security Solutions

Security requirements are as varied as the properties themselves, and no two properties will have the same security requirements. The most efficient security companies in Dubai will meet your needs and provide individual approaches to them. Do not go for companies that ask you to sign up for their security services without …