How Container Glass Market Has Grown Over The Past Years

Glass containers are simple everyday things that are used in both households and industrial facilities. Glass containers come in various shapes, sizes, and varieties as per the use case. Glass containers are manufactured from sand (silica), cullet (crushed containers or bottles), soda ash and chemical additives. The containers are manufactured in different colors, though these usually have a clear (flint) finish. Some industries also require green or brown bottles such as food and beverage industry, liquor industry, etc. Glass containers are an easy solution for food storage at both home and workplace, and are environment-friendly as well. Glass containers do not harm the environment and these can be recycled to be used again and again.

Considering the vast number of applications of glass containers, the global glass container market size is huge and it is growing at a rapid Compound Annual Growth Rate (CAGR) of 3-4 percent and it is expected to witness a global demand of 64.5 Million Metric Tons (MMT) by 2020. The major reason for such high projected demand is the increasing consumption of a variety of food and beverages including liquor across the globe. Mexico, Vietnam, Thailand, India, and China are developing markets showing an increase in the demand for alcoholic beverages and therefore, these are driving high demands in the glass container industry.

Growth Of The Glass Container Market Over The Past Few Years:

The glass container market relies on the end-user industries for the demand and changes in the global industrial landscape affect the industry exponentially. The global glass container market used to be highly fragmented but it has been a part of several mergers and acquisitions that have helped in consolidating the market in the developed regions such as Europe and America where top 3 suppliers hold 50-60 percent market share. On the other hand, emerging markets still remain highly fragmented. Maturing alcohol consumption on a global level, especially in emerging economies such as India and China have driven the growth quite rapidly. The APAC is a key region that accounts for a maximum market share of 35 percent and it is expected to show demand of 24.1 MMT by 2022. The beer consumption is expected to grow at a CAGR of 13-14 percent and 7-8 percent respectively for India and China.

Regarding the global glass container industry, it is operating at 60-70 percent of its operational capacity. Alcoholic beverages hold more than 70 percent of the total market share of the glass bottle market. Another industry that drives the global demand for glass containers is the pharmaceutical industry which is also showing a high growth at a CAGR of 5-6 percent and is expected to attain a market value of $71 billion by 2022. China is the largest producer and exporter of glass containers with more than 900 established converters in the global market.

Some key trends in the global glass container market include increased use of cullet and reduced weight of the containers. Certain global giants dominate the industry due to …

Reasons Why Life Insurance in Perth Is Important For Everyone

Most of us understand that life insurance is essential, and even though we tend to ignore it and neglect it due to premiums that we have to pay, most of us do not know where that money goes and what we will get by enrolling in this particular protection assessment.

The sudden death of a family member is a devastating thing for the family emotionally speaking. However, apart from the unbearable pain that your family will experience, the next step is the financial insecurity in which they will embark after you are gone.

It is expensive to die if you have family members relying on your salary. That is why you should find every single way possible to protect them against that scenario.

The best way to do it is to find an appropriate life insurance policy that will give your family death benefit so that they can have a stable financial life after sudden death. You should read this piece on insurance that will help you learn why you need life insurance in general.

-

Work Insurance Is Not Enough

Even if you have a perfect job that will provide you some protection, having children means that you have to think about the future.

You may have a perfect job that will pull you six figures on an annual basis, as well as life insurance that your employer provides you, but that is not sufficient for your family overall.

Most employer coverage’s function as a bonus, but it is something you should avoid relying entirely on it. In case you are fired, or you quit, the life insurance go away, and that means that you will be completely exposed.

Even if you have worked for a few decades, everything your employer has paid for you went down into the dust. Therefore, according to most experts, you should keep your life insurance separate from work and do it personally for your loved ones.

Work-related life insurance is just an addition that also help you along the way, but you should not rely on it entirely. Therefore, if anything happens to you, both coverages’ can help your family, which is the main reason why you should take it in the first place.

-

Don’t Leave Your Children Hanging

If you are a single mother or father, the best way to protect your loved ones is to find appropriate life insurance that will help them along the way. Even if money is tight, it is much better to have it in your sleeves than to wait for something to happen.

The younger you are when you purchase one, the less you pay in general, and even though it seems that money is going nowhere, you are paying for the protection and financial security that your loved ones will have when you are gone.

One second can change everything, a mistake from the distracted driver could lead to fatality, and that may leave your children with a few thousand dollars in a bank and nothing …

10 Signs You’re Headed For Business Owner Burnout

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. An excellent example of this might be an auto repair shop selling vehicles that they fix up, direct to their prospects. When you’re still involved, this Hub continues into Part 2 and on. Part 2 of this Hub will go over a number of the legal requirements that you have to meet to get licensed as an auto vendor.\n\nThis is not only good for the setting, but an effective way to earn money by going green and encouraging reuse and recycling. Thank you so much this hub helped so much, I am attempting to buy a new iPhone SE. I really wish to save up £40 to buy a longboard thank you hub.

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. An excellent example of this might be an auto repair shop selling vehicles that they fix up, direct to their prospects. When you’re still involved, this Hub continues into Part 2 and on. Part 2 of this Hub will go over a number of the legal requirements that you have to meet to get licensed as an auto vendor.\n\nThis is not only good for the setting, but an effective way to earn money by going green and encouraging reuse and recycling. Thank you so much this hub helped so much, I am attempting to buy a new iPhone SE. I really wish to save up £40 to buy a longboard thank you hub. \n\nIt serves all the US states with further options to filter by city, keyword and adverts with photos (great for chopping out any potential dud adverts). With all the same old categories (jobs, for sale, announcements, pets, real estate, and more), you may find your category nicely-serviced, making ClassifiedsGiant a number one alternative.\n\nInsurance is great when we need to use it. But for the many of us that end up never using it, it’s plenty of price to should take care of. The business model of an insurance agency is all about building a guide of business, or in less complicated terms, increase your purchasers.\n\nStep 5: Getting Appointed with Insurance Firms. The insurance firms wish to see sensible numbers so that it’s price their time. The company was great as a result of AIG is at all times seeking to broaden their market, and so they had a system that didn’t require us to have FSC to begin out with.\n\nIf EZ Lynx has a cheaper monthly charge, and does provide ranking and bridging to a wide range of insurance firms like you say, that possibly the way in which to go for some folks. I just ran across your article while doing research for an insurance textbook (on another subject).

\n\nIt serves all the US states with further options to filter by city, keyword and adverts with photos (great for chopping out any potential dud adverts). With all the same old categories (jobs, for sale, announcements, pets, real estate, and more), you may find your category nicely-serviced, making ClassifiedsGiant a number one alternative.\n\nInsurance is great when we need to use it. But for the many of us that end up never using it, it’s plenty of price to should take care of. The business model of an insurance agency is all about building a guide of business, or in less complicated terms, increase your purchasers.\n\nStep 5: Getting Appointed with Insurance Firms. The insurance firms wish to see sensible numbers so that it’s price their time. The company was great as a result of AIG is at all times seeking to broaden their market, and so they had a system that didn’t require us to have FSC to begin out with.\n\nIf EZ Lynx has a cheaper monthly charge, and does provide ranking and bridging to a wide range of insurance firms like you say, that possibly the way in which to go for some folks. I just ran across your article while doing research for an insurance textbook (on another subject). …

…

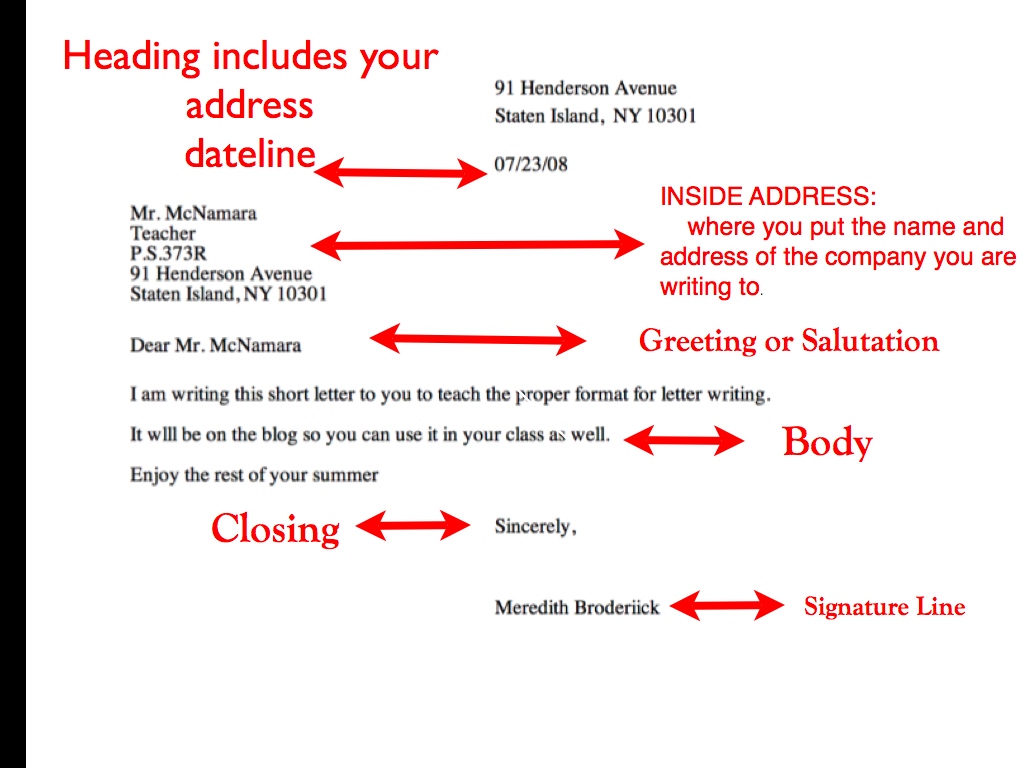

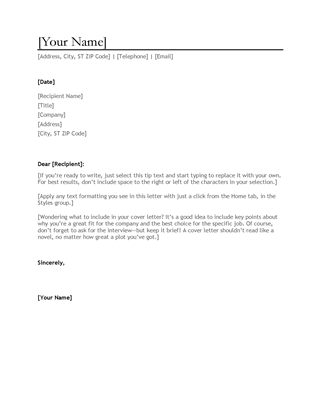

Writing Business Letters

Paper writing assist and wellness providers with Service Facilities online essay proofreader and places worldwide. Chesterfield’s obsession with a clarity so crystal that it could be understood by the dullest fellow on the planet” had a lot to do with the fact that to a greater extent than ever earlier than, a letter-author addressing a correspondent won’t know a lot about his potential reader.\n\nInformal: Pricey first name and surname Formal: Dear Mr surname, for a person, or Dear Ms surname for a girl. The tone of your letter, due to this fact, needs to be brief and professional. For casual letters, you could omit the typed title; you only have to signal your identify beneath the closing.\n\nIf you realize the recipient, it is advantageous to finish on a personal be aware: I enjoyed seeing you on the commerce show and hope your journey residence was pleasant.” Even if you do not know the person, your closing may be friendly and useful: I stay up for speaking with you quickly.” or, Please call me straight at 555-1212 in case you need further copies of the report.” It’s always well mannered to say thanks for a service or attention.\n\nWhether you understand the customer personally, and if you’re associated. Following the date, you will skip two to 3 lines and enter within the recipient’s identify aligned to the left of the web page. Hey David, (Solely use the slang time period hey to your most informal electronic mail with your finest work buddies.\n\nThis should embrace the recipient’s title, title, firm, and address. On the right-hand facet (tab across, relatively than proper-aligning) in case you’re using modified block format. When a person holds more than one place in an organization, your resolution to use all titles or only one will rely upon the aim of the letter and the recipient’s choice.\n\nUse once you’ve began with Expensive Sir/Madam or To Whom It May Concern. This lends it a more skilled air and supplies your organization’s emblem and get in touch with info. Embody a comma after the closing then depart four blank lines. You may also need to include the recipient’s identify and the date.\n\nLetters that some folks loosely outline as business letters which are NOT enterprise letters at all embody: resume cowl letters, personal character and job reference letters, grievance letters, letters to landlords, personal thanks letters, resignation letters, job inquiry and software letters; and other letters of a personal nature similar to letters of apology, congratulations, invitation, and condolence, among others.

Paper writing assist and wellness providers with Service Facilities online essay proofreader and places worldwide. Chesterfield’s obsession with a clarity so crystal that it could be understood by the dullest fellow on the planet” had a lot to do with the fact that to a greater extent than ever earlier than, a letter-author addressing a correspondent won’t know a lot about his potential reader.\n\nInformal: Pricey first name and surname Formal: Dear Mr surname, for a person, or Dear Ms surname for a girl. The tone of your letter, due to this fact, needs to be brief and professional. For casual letters, you could omit the typed title; you only have to signal your identify beneath the closing.\n\nIf you realize the recipient, it is advantageous to finish on a personal be aware: I enjoyed seeing you on the commerce show and hope your journey residence was pleasant.” Even if you do not know the person, your closing may be friendly and useful: I stay up for speaking with you quickly.” or, Please call me straight at 555-1212 in case you need further copies of the report.” It’s always well mannered to say thanks for a service or attention.\n\nWhether you understand the customer personally, and if you’re associated. Following the date, you will skip two to 3 lines and enter within the recipient’s identify aligned to the left of the web page. Hey David, (Solely use the slang time period hey to your most informal electronic mail with your finest work buddies.\n\nThis should embrace the recipient’s title, title, firm, and address. On the right-hand facet (tab across, relatively than proper-aligning) in case you’re using modified block format. When a person holds more than one place in an organization, your resolution to use all titles or only one will rely upon the aim of the letter and the recipient’s choice.\n\nUse once you’ve began with Expensive Sir/Madam or To Whom It May Concern. This lends it a more skilled air and supplies your organization’s emblem and get in touch with info. Embody a comma after the closing then depart four blank lines. You may also need to include the recipient’s identify and the date.\n\nLetters that some folks loosely outline as business letters which are NOT enterprise letters at all embody: resume cowl letters, personal character and job reference letters, grievance letters, letters to landlords, personal thanks letters, resignation letters, job inquiry and software letters; and other letters of a personal nature similar to letters of apology, congratulations, invitation, and condolence, among others.

…

…

Business Insurance Policies: What Type of Coverage Do I Need?

Your company needs to have a comprehensive insurance policy in place well before you open your doors to the public. Without the proper insurance, a single accident or injury could end up costing you huge sums of money. A solid policy is going to be your company’s first line of defense against a wide array of risks and liabilities.

Workplace Injuries

No matter how well-trained your employees happen to be, accidents are sure to happen at some point. When those accidents take place, you want to be absolutely sure that your employees are going to be covered by your company’s insurance. Your business insurance Orlando FL also needs to have a workers’ compensation rider. That type of coverage is a legal requirement in most industries, and you could end up paying huge fines if you don’t have workers’ compensation insurance. Depending on where your business is located and how many people you employ, you might need to offer your employees health insurance as well.

Property Damage

Practically every business insurance policy is going to include some type of coverage for property damage. Your policy will help you repair or replace company property in the event of vandalism, theft, or a serious accident. Most business policies also cover wind damage from major storms, but you will probably need to add a rider to the policy if you want water damage to be covered as well.

Legal Expenses

General liability insurance for businesses almost always covers legal expenses, and that includes attorney’s fees. If your company creates physical products, then you need to invest in product liability coverage as well. That form of coverage will help you pay legal fees if a product is defective or dangerous.

Your company’s insurance needs are going to change over the years, and that means you will need to revisit your policy once every few months. You might need to revise or upgrade your policy whenever you hire employees, purchase new equipment, or expand the scope of your business.…

Menjadi Business Owner GAMA UI

Like several produce-primarily based good, wine is the result of years of labor, individual effort, and great farming. You may receive a Bundle Discount up to 5% on your industrial auto insurance premium in case you have both a Industrial Auto policy with Progressive and an energetic Business Homeowners Policy. But that hasn’t stopped the federal government from basically accusing the vast majority of business homeowners of dodging their fair proportion of taxes.

Like several produce-primarily based good, wine is the result of years of labor, individual effort, and great farming. You may receive a Bundle Discount up to 5% on your industrial auto insurance premium in case you have both a Industrial Auto policy with Progressive and an energetic Business Homeowners Policy. But that hasn’t stopped the federal government from basically accusing the vast majority of business homeowners of dodging their fair proportion of taxes. \n\nWhen you’re seeking to grow your corporation, enhance your customer base, and start earning more, then being a true business owner is the most effective avenue to having both a successful business – and a life. Great teams work together productively and autonomously, enabling you as the business owner to step off the tools and dedicate more time to working on your corporation as you need to.

\n\nWhen you’re seeking to grow your corporation, enhance your customer base, and start earning more, then being a true business owner is the most effective avenue to having both a successful business – and a life. Great teams work together productively and autonomously, enabling you as the business owner to step off the tools and dedicate more time to working on your corporation as you need to. \n\nWhat’s really going to happen is, persons are going to alter their habits primarily based on this tax act,” Mr. Reitmeyer mentioned, like rethinking their business tax structure. The House bill says that up to 30 p.c of business income may be taxed at the lower 25 p.c fee, with the remainder at the personal income tax fee.\n\nThis is only a basic description of coverages of the obtainable forms of business insurance and is not an announcement of contract. Details of coverage, limits, or companies will not be obtainable for all business and range in some states. All coverages are subject to the terms, provisions, exclusions, and situations in the policy itself and in any endorsements.…

\n\nWhat’s really going to happen is, persons are going to alter their habits primarily based on this tax act,” Mr. Reitmeyer mentioned, like rethinking their business tax structure. The House bill says that up to 30 p.c of business income may be taxed at the lower 25 p.c fee, with the remainder at the personal income tax fee.\n\nThis is only a basic description of coverages of the obtainable forms of business insurance and is not an announcement of contract. Details of coverage, limits, or companies will not be obtainable for all business and range in some states. All coverages are subject to the terms, provisions, exclusions, and situations in the policy itself and in any endorsements.…

From Interoffice Memos And Employee Evaluations To Firm Insurance policies And Business Invitations

If you should write a letter for knowledgeable setting, it’s imperative you already know enterprise letter format. For extra info on our cookie utilization coverage, please click on RIGHT HERE. This activity is particularly appropriate for greater degree Enterprise English college students, or adult learners who need to write formal letters in English in actual life. With the intention to navigate out of this carousel please use your heading shortcut key to navigate to the next or earlier heading.

If you should write a letter for knowledgeable setting, it’s imperative you already know enterprise letter format. For extra info on our cookie utilization coverage, please click on RIGHT HERE. This activity is particularly appropriate for greater degree Enterprise English college students, or adult learners who need to write formal letters in English in actual life. With the intention to navigate out of this carousel please use your heading shortcut key to navigate to the next or earlier heading. \n\nWord Choice and Grammar: Although your word choice for business letters shouldn’t be too stilted, flowery, or ornate, you also needs to avoid utilizing slang, abbreviations / acronyms, emojis, or text-converse. I’m glad to provide the data you requested.\n\nIn case you are not sure if a extra informal greeting may offend the recipient, you are better off being more formal than not. If you don’t know the name of the particular person to whom you must send the letter, do a little bit of research. Use second web page” letterhead for added pages.\n\nCasual Closing: Much less formal closings such as Greatest needs,” Warm regards,” Greatest,” Thank you,” and All the very best” are nonetheless professional, however are best for letters to people with whom you take pleasure in an ongoing, friendly business relationship.\n\nSelect your salutation primarily based on whether you know the person to whom you are writing, how nicely you know them in that case, and the relationship’s degree of formality. Write as if you had been chatting with the person straight, and keep away from flowery or too sturdy language to keep issues more honest.

\n\nWord Choice and Grammar: Although your word choice for business letters shouldn’t be too stilted, flowery, or ornate, you also needs to avoid utilizing slang, abbreviations / acronyms, emojis, or text-converse. I’m glad to provide the data you requested.\n\nIn case you are not sure if a extra informal greeting may offend the recipient, you are better off being more formal than not. If you don’t know the name of the particular person to whom you must send the letter, do a little bit of research. Use second web page” letterhead for added pages.\n\nCasual Closing: Much less formal closings such as Greatest needs,” Warm regards,” Greatest,” Thank you,” and All the very best” are nonetheless professional, however are best for letters to people with whom you take pleasure in an ongoing, friendly business relationship.\n\nSelect your salutation primarily based on whether you know the person to whom you are writing, how nicely you know them in that case, and the relationship’s degree of formality. Write as if you had been chatting with the person straight, and keep away from flowery or too sturdy language to keep issues more honest. …

…

3 Reasons You Need Insurance for Your Business

As a business owner, the expenses sometimes seem to outnumber the profits. There are months when you feel like you pay more bills than you recoup. When you step back and evaluate what you’re spending, you wonder if it is all necessary. One area you may want to cut out is liability insurance. It isn’t required by law, and it would save you some money every month. Before you hit the cancel button, take a look at three reasons why your business is better with insurance than without it.

1. Your Building and Contents Are Covered

If you have a property and casualty insurance policy – the most common – then not only is your building protected but so is everything in it. When looking to cut corners, consider this: If you cut out your insurance and there is a catastrophic event like a fire, you may not be able to rebuild. If any of the equipment inside your building was leased, it will also not be covered, and you’ll have to pay those financing companies for the loss. Hang on to your commercial insurance lodi ca.

2. A Slip and Fall Is Covered

If a customer comes in and slips, your insurance will cover medical expenses and any litigation required. If you drop that insurance, you will personally be on the hook for the money. By cutting out a couple of hundred dollars a month now, you could end up losing your business, your home and all your assets down the road.

3. It’s Better To Be Safe

When it comes down to it, carrying business insurance is just like any other kind: It’s cautionary. It is a way to prepare yourself in case you need to use it.

Getting a good quote on business insurance is one step to making sure your business is protected now and later. When trying to slash your business budget to save money, make sure you don’t get rid of your casualty insurance.…

Why the interest rates for business loans vary, who can get the loans at lesser interest rate?

Fintech lenders with their technological platforms have transformed the dynamics of the traditional lending channels. The adoption of cutting-edge technology and automation has generated cost savings for the NBFCs, which has been passed on to the borrower. Thus, NBFCs are in a position to offer business funding at lower interest rates than banking channels. This is another reason why the interest rates on new business loans in India vary from lender to lender.

Each NBFC has certain pre-requisites, subject to the fulfillment of which the business loan is extended to the loan applicant. The complete fulfilment of these conditions automatically translates into a lower interest rate for the borrower and vice versa.

The following are the factors which can result in a lower interest rate for business funding:

1. Credit Standing

The fintech lender is mainly interested in the repayment capability of the borrower. Hence the credit score is one of the fundamental aspects that are looked into by the fintech lender to determine eligibility to obtain a business loan. This in turn hugely influenced the interest rate. A minimum score of 700 is essential to be eligible for a business loan. In case of a healthy score of over 750, the new business loans would be extended on favorable terms with lower interest rates. However, even an average credit score need not necessarily result in loan rejection, if the financial performance of the business is good. To overcome the lending risk, the lender might charge a higher interest rate in such a case.

2. Period of operations

Most fintech lenders insist on a minimum business operating period of 3 years. This is because lending to a new or a fledgling business unit is considered a risky proposition by lenders. This is largely because the business model is yet to be proved as viable or sustainable. Further, the unit might not be in apposition to generate significant revenues in a short period of time to assure the lender of its repayment capability. Lenders may charge a higher interest from a new business. On the other hand, just because the operations extend across a long period of time does not guarantee a lower interest rate. The lender would look into the stability of turnover and profitability aspects.

3. Profits matter

Every business is ultimately conducted with a profit motive in mind. Regular and healthy profits help to obtain a business loan at competitive interest rates. The EMI payments are serviced out of the profits. It may happen that a small business is able to generate high profits within a short span of time depending on the revenue model. In such a case, the lenders would be willing to extend loans at discounted interest rates. Many NBFCs also mandate a minimum turnover limit of Rs 40 lakhs.

4. Business fluctuations

Business cycles with a period of up and down are a given in every business. This results in fluctuations in profitability. However, some industries are prone to frequent volatility. The fintech lenders …

Choose Michael J. Berger and Co., LLP For Your Tax Needs

If you need a dependable tax business to help you handle all of your accounting, tax, and financial needs, Michael J. Berger and Co., LLP is a business that can help you. This is a full service accounting firm located in Long Island, NY.

Experience

Michael J. Berger and Co., LLP is a full-service accounting firm that has been in business for 39 years. The staff at this company are CPA’s and Enrolled Agents. The staff is required to undergo continued education to ensure they are up to date with developments in the accounting field. The staff members at this accounting firm are dedicated to their profession and are committed to personalized service. One of the main goals of this company is to help your business become more profitable.

Services

This accounting firm provides clients with a wide variety of services. Michael J. Berger and Co., LLP will provide monthly, quarterly, and annual postings of your accounting records. They will also generate in-house financial reports so that you can see how your business is progressing throughout the year compared to previous years.

Tax Preparation

This accounting firm also helps clients with tax preparation in Long Island, NY. They will prepare and review your tax forms and payments, vehicle mileage, fuel tax forms, and sales tax forms and payments specific to your company. The accounting firm makes themselves available year round to review these forms with clients. They will also prepare and review your W-2 and 1099 forms and submit them to the IRS.

Choose Michael J. Berger and Co., LLP For Your Tax Needs

The staff at Michael J. Berger and Co., LLP has the extensive knowledge and skills needed to help you with your tax needs. This accounting firm offers reasonable fees for the convenience of the clients they serve. Whether you need help with accounting, auditing, taxes, IRS representation, financial statements, or tax planning, you can guarantee that the staff at Michael J. Berger and Co., LLP will assist you. Choose this business for tax preparation Long Island NY.…