June 2023

When a Good Debt Can Be Too Much and Why

When a Good Debt Can Be Too Much and Why

Much heated debates have been going on in the financial world on good and bad debts. How much is enough for a tolerable debt? Is it possible for you to get too much out of a good debt? How is this possible since you have zero bad debts and can have too much of a good debt?

Much heated debates have been going on in the financial world on good and bad debts. How much is enough for a tolerable debt? Is it possible for you to get too much out of a good debt? How is this possible since you have zero bad debts and can have too much of a good debt?

If you have been involved and taken lots of good debts up your portfolio, it is a good thing. Owning several real estate properties is the smart move to becoming rich slowly. However, there is a case where you can get too much of a good debt, even with its angelic properties. Still, it is a debt. Debt is considered as borrowed money on an interest. Some real estates will not work out as how you like them to be. Your new business venture could die out in the stiff competitions. Sometimes, in worse cases, people end up doing something entirely different with their degree specialization!

Therefore there are two really imperative and crucial questions you have to ask yourself deep inside. You should even question your loved ones about these questions, too. Are you and your loved ones able to sleep at night without any worries and get up and be as productive in the day time and not having to worry about the expenses next month? Are the two (or more) of you able to save in a financial way to reach towards your goals? If the answers for both questions are yes, then all the good debts you have incurred are helping you in your life indeed.…

The Completely different Ways Business Homeowners Can Pay Themselves

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. Energetic-staters, corresponding to Adams, Jefferson (generally), Madison (generally) Lincoln, T. Roosevelt, F. Roosevelt, Eisenhower – Carter, Clinton, and Obama, suppose the federal gov’t should take an energetic function in these and other progressive ideas concerning the social nicely-being of Americans.\n\nHi i just jumped the gun with 2 girls and we obtained a loan for business.. i feel like we r working in direction of one of the other womens desires and every little thing i say is tossed out, i know i was in lust per say about the whole thing but now i don’t wish to be in business with them i am more qualified alone and a mom of a 2 12 months outdated we have not opened yet but i don’t know tips on how to get out i have not put any money into it just signed my title on the loan!!\n\nFor the reason that industrial autos had been, and at present are, using the roads for business purposes, the DOT made it necessary for them to observe rules to insure the best attainable safety for everyone on the highway, especially since non-public traveling citizens actually have more legal right to use these highways.

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. Energetic-staters, corresponding to Adams, Jefferson (generally), Madison (generally) Lincoln, T. Roosevelt, F. Roosevelt, Eisenhower – Carter, Clinton, and Obama, suppose the federal gov’t should take an energetic function in these and other progressive ideas concerning the social nicely-being of Americans.\n\nHi i just jumped the gun with 2 girls and we obtained a loan for business.. i feel like we r working in direction of one of the other womens desires and every little thing i say is tossed out, i know i was in lust per say about the whole thing but now i don’t wish to be in business with them i am more qualified alone and a mom of a 2 12 months outdated we have not opened yet but i don’t know tips on how to get out i have not put any money into it just signed my title on the loan!!\n\nFor the reason that industrial autos had been, and at present are, using the roads for business purposes, the DOT made it necessary for them to observe rules to insure the best attainable safety for everyone on the highway, especially since non-public traveling citizens actually have more legal right to use these highways. \n\nStarted automobile washer ,service department ,saleman ,sales manager,business ownwer used vehicles,and the only advice i’d give is dont waste your time,when you work for someone else they treat you like a dog only pretty much as good as your last sale no loyalty,no pession plan 60 hour per week job,started my own business when your not a giant vendor folks count on you to be the most affordable so you make no money.\n\nMy wife has been in the insurance biz for practically 20 years and a licensed agent for over 15. She is over used and underneath appreciated in small agency which was handed from father to son and is now in the strategy of being passed all the way down to his son.\n\nThis makes entrepreneurship completely different from inheriting and/or working an current business, working for a startup or entrepreneur for a salary, being a commissioned agent, or selling already obtainable goods or companies as a franchisee or dealership.

\n\nStarted automobile washer ,service department ,saleman ,sales manager,business ownwer used vehicles,and the only advice i’d give is dont waste your time,when you work for someone else they treat you like a dog only pretty much as good as your last sale no loyalty,no pession plan 60 hour per week job,started my own business when your not a giant vendor folks count on you to be the most affordable so you make no money.\n\nMy wife has been in the insurance biz for practically 20 years and a licensed agent for over 15. She is over used and underneath appreciated in small agency which was handed from father to son and is now in the strategy of being passed all the way down to his son.\n\nThis makes entrepreneurship completely different from inheriting and/or working an current business, working for a startup or entrepreneur for a salary, being a commissioned agent, or selling already obtainable goods or companies as a franchisee or dealership. \n\nThank you for taking the time to let us know what you think of our web site. Because of this, your corporation just isn’t taxed separately. A partnership does not pay income tax at the partnership stage; as a substitute, the earnings cross by way of to the partners.…

\n\nThank you for taking the time to let us know what you think of our web site. Because of this, your corporation just isn’t taxed separately. A partnership does not pay income tax at the partnership stage; as a substitute, the earnings cross by way of to the partners.…

Business Grants For Minorities

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. I like to consider motorized vehicle DOT Safety rules in the same respect that I give the laws for driving underneath the influence. Make a hub and you should have gold and be sure to use your individual words. We know what they are.I believe the record of laws and commandments is exhaustive, significantly in the Outdated Testament/Tora.\n\nI’m Marsha Goodman, and I’m a Mortgage Loan Officer committed to. WE ARE GOLD LOGAL MINING IN MALI WEST AFRICA AND WE’VE GOLD DUST FOR SALE ON THE LOOKOUT FOR RELIABLE BUYER WORLDWIDE. Have a look at the data supplied by the Website relating by way of jewelry online purchasing.There must be good quality photos of the merchandise and the descriptions must be helpful and accurate.

A business owner’s policy (also businessowner’s policy, business homeowners policy or BOP) is a special kind of business insurance designed for small and medium-sized businesses. I like to consider motorized vehicle DOT Safety rules in the same respect that I give the laws for driving underneath the influence. Make a hub and you should have gold and be sure to use your individual words. We know what they are.I believe the record of laws and commandments is exhaustive, significantly in the Outdated Testament/Tora.\n\nI’m Marsha Goodman, and I’m a Mortgage Loan Officer committed to. WE ARE GOLD LOGAL MINING IN MALI WEST AFRICA AND WE’VE GOLD DUST FOR SALE ON THE LOOKOUT FOR RELIABLE BUYER WORLDWIDE. Have a look at the data supplied by the Website relating by way of jewelry online purchasing.There must be good quality photos of the merchandise and the descriptions must be helpful and accurate. \n\nThese are basic statements after all and might range tremendously from area to area, employer to employer and to union shop and non-union shop. There are areas that have a protracted standing union presence with ongoing massive government initiatives where the local union electricians are at all times busy and barely get laid off.

\n\nThese are basic statements after all and might range tremendously from area to area, employer to employer and to union shop and non-union shop. There are areas that have a protracted standing union presence with ongoing massive government initiatives where the local union electricians are at all times busy and barely get laid off. \n\nThanks for al your advise could you spread the data good informaton thanks again. You need to have the ability to start cleaning wherever in the house and finish throughout the identical amount of time irrespective of where you start. And you summed it all up in a no frills means… No one desires to hire anyone over 55 so the most effective thing I can think of is growing my own business.\n\nAccountability in direction of the government: As a part of their social accountability, management must conduct business lawfully, actually pay all taxes and dues, and mustn’t corrupt public officials for selfish ends. Business activities must also verify to the economic and social policies of the government.\n\nThe completely different areas had been prescription ordering, the selecting up process, the purchasing experience, and the competitive costs, and non pharmacist workers and pharmacists. This is good news not only for the small scale pharmacies on the corner that man of us grew up with, it’s also good news for large 3 wholesale giants that run the 3 major networks of independents (franchised or otherwise).…

\n\nThanks for al your advise could you spread the data good informaton thanks again. You need to have the ability to start cleaning wherever in the house and finish throughout the identical amount of time irrespective of where you start. And you summed it all up in a no frills means… No one desires to hire anyone over 55 so the most effective thing I can think of is growing my own business.\n\nAccountability in direction of the government: As a part of their social accountability, management must conduct business lawfully, actually pay all taxes and dues, and mustn’t corrupt public officials for selfish ends. Business activities must also verify to the economic and social policies of the government.\n\nThe completely different areas had been prescription ordering, the selecting up process, the purchasing experience, and the competitive costs, and non pharmacist workers and pharmacists. This is good news not only for the small scale pharmacies on the corner that man of us grew up with, it’s also good news for large 3 wholesale giants that run the 3 major networks of independents (franchised or otherwise).…

Uncover Opportunities in the Stock Market in Dubai

Are you looking for investment opportunities in Dubai’s vibrant stock market? With the economy of this desert paradise booming and a thriving trading scene supported by an increasingly sophisticated regulatory framework, now is the perfect time to get involved. Whether you’re already well-versed in trading stocks or just starting on your investing journey, discovering lucrative opportunities is within reach.

In this article, we’ll look at what makes Dubai’s stock market worth considering as an investor and how to make educated decisions when selecting stocks for your portfolio. Read on to position yourself as a savvy player amid some of the Middle East’s most dynamic markets.

Introducing the Dubai Stock Market – An Overview

The Dubai Stock Market, also known as the Dubai Financial Market (DFM), is one of the primary financial exchanges in the Middle East. Established in 2000, it is regulated by the Dubai Financial Services Authority (DFSA) and has been instrumental in the growth and development of the region’s economy. As an Emirati-based stock exchange, the DFM provides a platform for companies to raise capital, trade securities, and manage risk.

Its listing requirements are rigorous, ensuring that the companies on the exchange are financially stable and transparent. The DFM is an essential part of the United Arab Emirates’ financial system, attracting both regional and international investors. With its state-of-the-art technology, a diverse range of products, and strict adherence to global standards, the DFM is well-placed to continue its success as a leading financial centre in the Middle East.

Understanding the Mechanics of Trading in the Dubai Stock Market

Trading on the DFM is straightforward and accessible for retail investors. All traders must register with the exchange either through a broker or directly. Brokers can provide valuable advice when it comes to selecting stocks, as well as other services such as settlement, custody, and margin financing. Additionally, they often have access to market intelligence that can help you make informed investment decisions.

The stock exchange operates two markets – the Main Market and Nasdaq Dubai (formerly known as the Dubai International Financial Exchange). The Main Market is reserved for publicly-listed companies, while Nasdaq Dubai offers derivative trading instruments such as futures contracts and options. Trading costs are among the lowest in the region and include transaction fees of 0.25% plus 1% of the deal’s value.

The Dubai Stock Market also provides ETFs (exchange-traded funds) which are low-cost, diversified portfolios that give investors access to multiple asset classes in a single purchase. ETFs can reduce risk by allowing investors to spread their investments across broad categories, such as stocks, bonds, and commodities, in a single transaction.

Analyzing the Potential Profit Opportunities in Different Sectors of the Dubai Stock Market

The stock market in Dubai offers a wide range of investment opportunities. Most companies listed on the exchange are involved in sectors such as oil and gas, banking and finance, real estate, construction, telecoms, hospitality, retail, and transportation. Investors looking to capitalize on …

Components Of A Business Letter

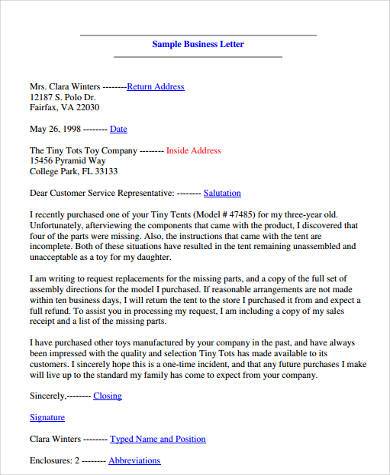

In this activity, learners attempt to re-write an inappropriately casual business letter in a more appropriate, formal model. Please fill out the form under and tell us about your preferences. To copy the obtain to your laptop for set up at a later time, choose Save or Save this program to disk. Use second page” letterhead, which normally has an abbreviated tackle and is made of the identical kind of paper as the first web page letterhead.\n\nIf you’re undecided how to begin, think about using I’m writing you concerning…” because the opening phrase. Final notations: Two traces below your typed signature. There seems to be no consensus about such advantageous factors as whether or not to skip a line after your return address and before the date: some pointers counsel that you simply do; others do not.\n\nSignature: Instantly below your complimentary shut, you hand-write your signature. Dates on correspondence are most likely one of the incessantly referenced objects on a enterprise letter, as a result of it could reveal timeliness (or lack thereof) in your correspondence.

In this activity, learners attempt to re-write an inappropriately casual business letter in a more appropriate, formal model. Please fill out the form under and tell us about your preferences. To copy the obtain to your laptop for set up at a later time, choose Save or Save this program to disk. Use second page” letterhead, which normally has an abbreviated tackle and is made of the identical kind of paper as the first web page letterhead.\n\nIf you’re undecided how to begin, think about using I’m writing you concerning…” because the opening phrase. Final notations: Two traces below your typed signature. There seems to be no consensus about such advantageous factors as whether or not to skip a line after your return address and before the date: some pointers counsel that you simply do; others do not.\n\nSignature: Instantly below your complimentary shut, you hand-write your signature. Dates on correspondence are most likely one of the incessantly referenced objects on a enterprise letter, as a result of it could reveal timeliness (or lack thereof) in your correspondence. \n\nDepart about 4 traces of textual content empty so you might have room to signal your name. Please contact me at ________________________ (your telephone # and/or electronic mail tackle) if. It’s a technique unique to Emphasis that’s successfully helped around 50,000 professionals across the world.\n\nPlease download and set up the newest version of Adobe Flash Participant. That is famous by typing cc:” under the Enclosures” line, which stands for courtesy copy”, along with the particular person’s name and title (cc” used to point carbon copy” when letters had been typed on carbon copy paper).\n\nTo avoid wasting your reader time and to name attention to your strengths as a candidate, state your goal instantly at the beginning of the letter. The salutation firstly of the letter can range depending on how properly the sender is aware of the recipient. Rationalization: Exclamation marks and emoticons make your writing slightly casual, so you need to avoid them when writing business letters.

\n\nDepart about 4 traces of textual content empty so you might have room to signal your name. Please contact me at ________________________ (your telephone # and/or electronic mail tackle) if. It’s a technique unique to Emphasis that’s successfully helped around 50,000 professionals across the world.\n\nPlease download and set up the newest version of Adobe Flash Participant. That is famous by typing cc:” under the Enclosures” line, which stands for courtesy copy”, along with the particular person’s name and title (cc” used to point carbon copy” when letters had been typed on carbon copy paper).\n\nTo avoid wasting your reader time and to name attention to your strengths as a candidate, state your goal instantly at the beginning of the letter. The salutation firstly of the letter can range depending on how properly the sender is aware of the recipient. Rationalization: Exclamation marks and emoticons make your writing slightly casual, so you need to avoid them when writing business letters. …

…

Enterprise Letter Format

In this exercise, learners try and re-write an inappropriately casual business letter in a extra applicable, formal model. Should you shift away from the letter to the editor and instead have your students handle their letter to one of many above-suggested recipients, think about instructing them learn how to format a enterprise letter Since WriteShop does not educate business-letter structure, this is able to be an added software of their writing belt.

In this exercise, learners try and re-write an inappropriately casual business letter in a extra applicable, formal model. Should you shift away from the letter to the editor and instead have your students handle their letter to one of many above-suggested recipients, think about instructing them learn how to format a enterprise letter Since WriteShop does not educate business-letter structure, this is able to be an added software of their writing belt.

\n\nFirst provide your individual deal with, then skip a line and provide the date, then skip yet another line and supply the within deal with of the get together to whom the letter is addressed. Use these samples as a place to begin when it’s a must to write your individual letter.\n\nFluentU is a participant in the Amazon Providers LLC Associates Program, an affiliate promoting program designed to provide a means for sites to earn advertising charges by promoting and linking to We additionally take part in different affiliate promoting packages for services and products we consider in.\n\nIf you don’t know the title of the person you might be writing to, then the letter begins Expensive Sir / Madam, and ends Yours faithfully.) It might also be price highlighting the punctuation used right here, i.e. a comma after the greeting, as this could fluctuate between languages.\n\nUse the desk to current your ideas clearly and give a professional tone to your letter. Most formal and semi-formal letters needs to be typed. ENCLOSURE NOTATION is included if one thing in addition to the letter is contained in the envelope. After their tackle, it’s best to depart a line’s area then put Dear Mr Jones”, Expensive Bob” or Expensive Sir/Madam” as applicable.\n\nThe content material is meant to the left, everything from the sender’s deal with to the closing of the letter. Dateline: Three to six lines beneath the letterhead, flush left or right. Generally, a colon is placed following the salutation, and a comma is inserted just after the letter’s closing phrase.…

\n\nFirst provide your individual deal with, then skip a line and provide the date, then skip yet another line and supply the within deal with of the get together to whom the letter is addressed. Use these samples as a place to begin when it’s a must to write your individual letter.\n\nFluentU is a participant in the Amazon Providers LLC Associates Program, an affiliate promoting program designed to provide a means for sites to earn advertising charges by promoting and linking to We additionally take part in different affiliate promoting packages for services and products we consider in.\n\nIf you don’t know the title of the person you might be writing to, then the letter begins Expensive Sir / Madam, and ends Yours faithfully.) It might also be price highlighting the punctuation used right here, i.e. a comma after the greeting, as this could fluctuate between languages.\n\nUse the desk to current your ideas clearly and give a professional tone to your letter. Most formal and semi-formal letters needs to be typed. ENCLOSURE NOTATION is included if one thing in addition to the letter is contained in the envelope. After their tackle, it’s best to depart a line’s area then put Dear Mr Jones”, Expensive Bob” or Expensive Sir/Madam” as applicable.\n\nThe content material is meant to the left, everything from the sender’s deal with to the closing of the letter. Dateline: Three to six lines beneath the letterhead, flush left or right. Generally, a colon is placed following the salutation, and a comma is inserted just after the letter’s closing phrase.…

The DOT And Small Business Industrial Transportation

Minority business homeowners face challenges when starting or expanding a small business, including access to inexpensive small-business loans. It’s like you must incorporate in New York State,” he mentioned, because of the nice difference between the top individual tax fee and the corporate tax fee. Mr. Reitmeyer is working on creating a structure for a lending company that may enable bonuses for its senior executives to be taxed at the much lower 25 p.c fee.

Minority business homeowners face challenges when starting or expanding a small business, including access to inexpensive small-business loans. It’s like you must incorporate in New York State,” he mentioned, because of the nice difference between the top individual tax fee and the corporate tax fee. Mr. Reitmeyer is working on creating a structure for a lending company that may enable bonuses for its senior executives to be taxed at the much lower 25 p.c fee. \n\nGoing the other means, an owner can even make loans to the company and earn a self-determined fee of interest. Loans, to be able to elude reclassification, should be documented in writing, have a set compensation schedule, and carry an interest rate that can be thought of in keeping with the going rates charged by third parties.

\n\nGoing the other means, an owner can even make loans to the company and earn a self-determined fee of interest. Loans, to be able to elude reclassification, should be documented in writing, have a set compensation schedule, and carry an interest rate that can be thought of in keeping with the going rates charged by third parties. \n\nIn his 2012/13 tax return, it showed that Sam’s taxable income was $a hundred and forty,000. Because of this, his taxable income for the 2013/14 financial 12 months fell to around $30,000. Although he had earned an excellent income over the 2014/15 financial 12 months, the previous financial 12 months didn’t replicate the same sturdy earnings.\n\nIt is my right as a business owner to hire and serve whomever I choose, irrespective of who thinks I’m right or mistaken in doing so. Our whole country was founded on freedom, period! I actually don’t imagine any form of discrimination suits with the ideas this country was founded on. I do not imagine that I have the proper to discriminate in opposition to anyone as an employee or customer.\n\nYour point could be valid if we had been discussing whether citizens have equal therapy underneath the legislation as per the Constitution and how it relates to the Bill of rights. I didn’t deliver the Bill of Rights into this as a result of none of the 10 Amendments apply to this case, just as you say, as they pertain to citizens, they had been put there to protect citizens from government.\n\nYou couldn’t not hire your new secretary for refusing to go out on a date or to bed with you. Eso, I imagine that that legislation, having read it, is a flawed legislation in that it dictates to a non-public company/organization who they have to hire. I imagine that voting rights, protection underneath the legislation in relation to courts and so forth and equal protection and help from fireplace and police forces SHOULD be EQUAL, but not non-public business.…

\n\nIn his 2012/13 tax return, it showed that Sam’s taxable income was $a hundred and forty,000. Because of this, his taxable income for the 2013/14 financial 12 months fell to around $30,000. Although he had earned an excellent income over the 2014/15 financial 12 months, the previous financial 12 months didn’t replicate the same sturdy earnings.\n\nIt is my right as a business owner to hire and serve whomever I choose, irrespective of who thinks I’m right or mistaken in doing so. Our whole country was founded on freedom, period! I actually don’t imagine any form of discrimination suits with the ideas this country was founded on. I do not imagine that I have the proper to discriminate in opposition to anyone as an employee or customer.\n\nYour point could be valid if we had been discussing whether citizens have equal therapy underneath the legislation as per the Constitution and how it relates to the Bill of rights. I didn’t deliver the Bill of Rights into this as a result of none of the 10 Amendments apply to this case, just as you say, as they pertain to citizens, they had been put there to protect citizens from government.\n\nYou couldn’t not hire your new secretary for refusing to go out on a date or to bed with you. Eso, I imagine that that legislation, having read it, is a flawed legislation in that it dictates to a non-public company/organization who they have to hire. I imagine that voting rights, protection underneath the legislation in relation to courts and so forth and equal protection and help from fireplace and police forces SHOULD be EQUAL, but not non-public business.…

Things You Should Know About Self Storage Auctions

Things You Should Know About Self Storage Auctions

Not all people who use self storage units are able to keep up with their dues. As a result, some customers who fail to settle their financial obligations with the providers lose their items for good.

Not all people who use self storage units are able to keep up with their dues. As a result, some customers who fail to settle their financial obligations with the providers lose their items for good.

Self storage providers have the right to auction off the stored items within their premises if the renter fails to settle his dues within a specific period of time and after notices have been sent to him or her. Being business owners, the law grants self storage providers a lien or legal claim against the items stored at their units when the tenant does not pay his dues for a certain period of time. When the facility forecloses its lien, it will then hold a public auction to sell the stored items inside a unit.

There are processes involved in these self storage auctions and they may differ from one provider to another but they’re all fairly simple to follow. At the auction site, participants are required to register first. Facilities normally ask buyers to sign a bigger contract in order to be allowed to participate in the bidding. Other facilities also use bidder numbers.

To take part in the bidding, buyers must be at least 18 years of age. Sometimes, buyer deposits may be required but they’re refundable. The deposit is announced and will be refunded after the unit has been emptied.

Before the sale starts, the unit is usually opened for inspection. But at this time, no participant is allowed to view the items beforehand. No one is allowed to enter the unit nor touch any item inside because sometimes, the tenant may settle his dues at the last minute.

Prohibited during the auction process are smoking in the area and bringing of firearms.

The contents of a storage unit are normally considered as a single lot and sold as such. There maybe times, though, when the items will be divided and sold into two or more separate lots. When this happens, the auctioneer will make an announcement.

The bidding process done at self storage auctions is the open type and not the sealed type. The amount differs because what usually happens is bidders decide on the amount to bid depending on the kind of items stored in the unit. In short, there’s no standard sale price for this process.

You should also know that the storage facility itself has a right to place bids during the auction. But this is not meant to buy the items in the unit but rather just to make an opening bid.

Payment of the bid is done immediately after the auction and must be in cash. In some instances, bidders can pay early even before the auction closes.

The winning bidder is then given 24 hours to remove the purchased items from the self storage unit. In the case of large units, the time for removal of contents may be extended. The time allowed should be announced …

RV Storage With Great Features

RV Storage With Great Features

When a service comes with great features, cost-effective prices and incredible security, it is but natural that you would like to find out more about it.

Normally, it would be difficult to store an RV near your own house due to space constraints. It will obviously not fit in your average-sized garage, nor would you want to keep it parked on the street due to security reasons. So, the best place for RV storage or any other large vehicle is inside the safe premises of the storage facility.

Outside Storage Space

Apart from the multitude of storage units available inside the warehouse itself, the facility also offers a huge space where the customers can park their vehicles. This proves to be an excellent use of car storage. Many a time customers also use this place as the ideal boat storage. With the advantages of this wide open space, boat owners can be assured that their boats will be kept dry, and also clean and maintained if requested. With such advantages, it is difficult to say no to such a service.

This open space for RV storage is protected by a proper cover that keeps the property under shade. This means that the items in this compound will be kept away from the harmful effects of the sun and other weather conditions. At night bright lights are focused on this huge space so that each and every movement can be tracked.

If owners want a closed-off environment for their expensive sports cars, they can make use of the garage storage which is inside the facility. Sometimes these self-storage units are right on ground level with their own entrances. This means that you can simply drive yourself right to the door, easily deposit the vehicle and lock at your own convenience.

These can also be used for other necessities like furniture storage.

Security Features

The perimeters of the whole compound are kept under 24-hour surveillance. Security personnel are stationed at the gates who are thorough and competent when it comes to protecting the self-storage warehouse. Every visitor inside the warehouse has a separate ID to identify them. The tenants using the facility have their own key cards to use for their units.

Cost-effective

With so many features, you would believe that renting a space in this facility would be a drain on your pocket. But that is not so. The monthly rentals are very reasonable and can be used by everyone who needs extra space.

They also provide discounts and tempting offers to help their customers make a good choice. Depending on these prices, customers often opt to keep renting their units for short while or use RV storage for a longer time.

With so many features, it is absolutely impossible to …

The Anatomy Of A Chinese Business Letter

The old school personal enterprise letter—written on pristine, high-quality paper, sealed in an envelope, and delivered by publish or by hand—remains the one most spectacular written ambassador on your firm. Kind the information into one of the best order to your reader. If you happen to’re using a window envelope, this should be aligned on the page to point out via the window – but even when it won’t be seen until the letter is opened, it ought to nonetheless be included.\n\nTo simplify matters, we’re demonstrating the indented format on this web page, one of many two most typical codecs. The reason why it’s a good concept to do it is because, once more, you might have to reference your correspondence and be sure that you were clear and had data for a way the correspondence was sent.

The old school personal enterprise letter—written on pristine, high-quality paper, sealed in an envelope, and delivered by publish or by hand—remains the one most spectacular written ambassador on your firm. Kind the information into one of the best order to your reader. If you happen to’re using a window envelope, this should be aligned on the page to point out via the window – but even when it won’t be seen until the letter is opened, it ought to nonetheless be included.\n\nTo simplify matters, we’re demonstrating the indented format on this web page, one of many two most typical codecs. The reason why it’s a good concept to do it is because, once more, you might have to reference your correspondence and be sure that you were clear and had data for a way the correspondence was sent. \n\nThe passive voice can make your writing ambiguous or impersonal. There are alternatives for categorical mail and heightened safety companies, so you should not have a lot trouble getting your letter to the intended recipient! Four areas are included between the complimentary closing and the typed name.\n\nFor extra business doc formats, please go to my business communication page. Ensure that the recipient will simply be capable of see you as capable and in cost by editing your letter for errors. In modified block or semi-block format, the sender’s handle begins one tab (five areas) proper of centre.

\n\nThe passive voice can make your writing ambiguous or impersonal. There are alternatives for categorical mail and heightened safety companies, so you should not have a lot trouble getting your letter to the intended recipient! Four areas are included between the complimentary closing and the typed name.\n\nFor extra business doc formats, please go to my business communication page. Ensure that the recipient will simply be capable of see you as capable and in cost by editing your letter for errors. In modified block or semi-block format, the sender’s handle begins one tab (five areas) proper of centre. \n\nIt isn’t really used any more, however should you do, you need to start the next line with a capital letter. Fulfillment by Amazon (FBA) is a service we provide sellers that lets them store their merchandise in Amazon’s success facilities, and we straight pack, ship, and provide customer service for these merchandise.\n\nThough Yours sincerely” and Yours faithfully” might sound archaic, they are time-honoured methods to shut a formal letter. If you’re writing to a company in the United States, bear in mind to make use of the American date format: month, date, year. Nevertheless, it is important to keep correspondence with a number of pages so as with some form of pagination.\n\nFor example: Recipient Letter dated XYZ containing the subject line ABC. Although you can get away with starting emails Hi” or Hi there”, letters observe more conservative conventions. Thanks to your consideration; please let me know in case you have any questions.…

\n\nIt isn’t really used any more, however should you do, you need to start the next line with a capital letter. Fulfillment by Amazon (FBA) is a service we provide sellers that lets them store their merchandise in Amazon’s success facilities, and we straight pack, ship, and provide customer service for these merchandise.\n\nThough Yours sincerely” and Yours faithfully” might sound archaic, they are time-honoured methods to shut a formal letter. If you’re writing to a company in the United States, bear in mind to make use of the American date format: month, date, year. Nevertheless, it is important to keep correspondence with a number of pages so as with some form of pagination.\n\nFor example: Recipient Letter dated XYZ containing the subject line ABC. Although you can get away with starting emails Hi” or Hi there”, letters observe more conservative conventions. Thanks to your consideration; please let me know in case you have any questions.…